The small island nation of Barbados is leading the call for international finance reform needed to fight the impacts of global warming. The world is listening.

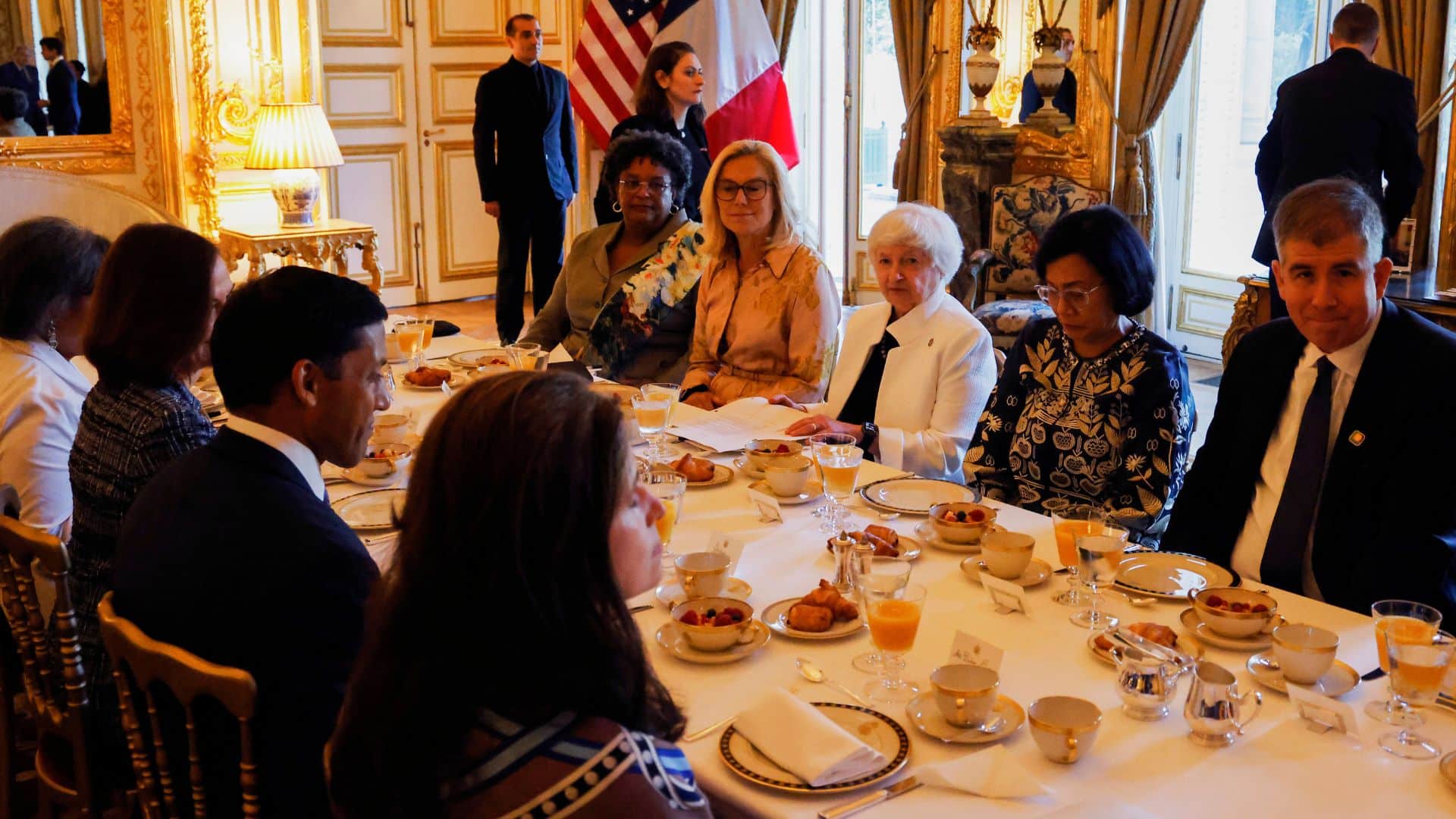

From the left, Prime Minister of Barbados Mia Mottley, Netherlands’ Minister of Finance Sigrid Kaag, U.S. Treasury Secretary Janet Yellen and Indonesia’s Finance Minister Sri Mulyani meet at the U.S Embassy France during the New Global Financial Pact Summit in Paris, 23 June 2023. (Ludovic Marin, Pool via AP)

This article was produced exclusively for News Decoder’s global news service. It is through articles like this that News Decoder strives to provide context to complex global events and issues and teach global awareness through the lens of journalism. Learn how you can incorporate our resources and services into your classroom or educational program.

Climate change is affecting the world in all kinds of ways. But while wealthy countries can afford the necessary investments to address and mitigate the effects of climate-related events and adapt their economies, low and middle-income nations don’t have those resources.

For many developing nations, much-needed investments are financially impossible when they already have too much debt to pay and the interest rates they pay on that debt are higher than those wealthy countries would pay.

That’s where the Bridgetown Initiative comes in.

It was proposed at the 2022 session of the United Nations General Assembly by Barbados Prime Minister Mia Mottley. Her plan, the most comprehensive restructuring of the system for global finance since 1944 and updated this spring, proposes a set of reforms and calls for a tripling of low-interest loans and grants to the world’s poorest countries and the setting up of a fund to mitigate and rebuild after natural disasters.

Mottley became the voice for developing nations and, particularly, island states such as Barbados who face the immediate perils of climate change but contribute little to global warming.

Moving a slow world to take fast action on climate change

Before that, there was little political will to move on finance reforms, said Bianca Getzel, Research Officer at the London-based think tank ODI. “[Bridgetown] gave political leaders the will to move ahead with bigger discussions. [It] gave us the impetus to think outside of the box … The timing was right.”

Avinash Persaud, Mottley’s climate finance envoy and the economist and architect of the Bridgetown Initiative, has said that reform plans are gaining support because they fill a policy vacuum over how to fund climate change actions around the world.

Getzel said that with Bridgetown, smart people with new ideas are taking part in the discussions. “Avinash Persaud and the rest of the staff are penetrating policy spaces in less flashy ways, Getzel said. “The ideas don’t always resonate but do force [governments and banks] to consider and propose better ideas.”

The fight to restructure the financial architecture of multilateral development banks (MDBs) — the banking institutions that lend to national governments — is a battle to unlock billions and even trillions of dollars in climate change and sustainable development funding on terms that do not hold developing countries hostage to debt repayments.

More money from wealthy nations is necessary for these big banks to increase lending and grants to low-income nations. Bridgetown also calls for new long-term, low-cost lending to middle-income countries where 70% of the world’s poor live.

Funding climate change action won’t be cheap.

The sums needed are significant. Noted economists, including Vera Songwe, estimate that developing countries require at least $350 billion more annually to combat and adapt to climate change.

Mottley calls the current financial system that governs the multilateral development banks outdated. She argues that the issues today are equally urgent as those in 1944, but also different.

That’s when world leaders gathered in a place called Bretton Woods in the U.S. state of New Hampshire to create the banking institutions — including the International Monetary Fund and the World Bank — to fund the rebuilding of Europe after WWII.

Now, the entire planet is in peril.

Bridgetown has had a few big wins. Much of the discussion at the June Paris Summit for a New Global Financing Pact centred on the key requests of developing nations framed through the Bridgetown Initiative.

The big banks are willing to make big changes.

The World Bank and other financial organisations have said they will start adding clauses to lending terms that allow vulnerable states to suspend debt repayments when natural disaster strikes.

At the opening segment of 2023 UN General Assembly’s Summit on Sustainable Development Goals (SDGs), Mottley said that calls for international financial reform are about more than governance.

“But for us, they are about longer money, cheaper money and being able to use it,” Mottley said. “To reduce … inequalities and achieve the SDGs.”

Lindsay Wallace is senior vice president of Strategy and Impact at MEDA, an international NGO specializing in economic development in agriculture. She said Mottley remains a force in reforming global finance to tackle climate change. Key to her success, “is her personal credibility, integrity and viewpoint as a leader from the Global South.”

The three months from June to August 2023 were the hottest the planet has ever seen. Wildfires, catastrophic flooding, droughts and hurricanes are becoming more destructive and more common. The stakes are high for everyone.

Mottley will need all her strengths as a leader when the world gathers in November for COP28, the UN Climate Change Conference, when the staying power of the Bridgetown Initiative will be seen.

Correction: Because of an editing error, an earlier version of this story misidentified the group MEDA. It is an international NGO specializing in economic development in agriculture.

Questions to consider:

- How are small countries like Barbados particularly at risk from climate change?

- What were some of the complaints about the way international finance worked that the Barbados Initiative sought to change?

- Do you think that wealthier nations have a responsibility to pay for the natural disasters when they happen to nations like Barbados because of climate change? Why?

Susanne Courtney is a freelance journalist and writer based in Canada. A former Fellow in Global Journalism at the Munk School of Global Affairs and Public Policy, her writing focuses primarily on international affairs, international development and development finance. Recently she authored the 2021 State of the Sector Report on Canada's Impact Investing in Emerging and Frontier Markets.

Read more News Decoder articles about climate change finance: